Due to the rapid expansion of terrestrial networks and applications, satellite customers are reconsidering their future commitment to geostationary satellites (GEOs). Steady expansion of F/O, 4G and soon, 5G networks will create a significant competition to satellite services of both Video and Data. While the total throughput will increase by all these terrestrial network investments, the bandwidth price will keep on falling down dramatically. The outbreak of bandwidth has led to an increased growth of Over-theTop (OTT) services. OTT viewing combines the power of digital advertising with the premium content of traditional television, creating one of the most compelling environments for viewers to engage with both the content they are watching, along with the advertiser’s message. There’s a strong appetite for OTT advertising as advertisers know that they must follow their audiences. According to TDG Research, advertisement spent on OTT is rapidly growing and projected to hit $40 billion by 2020, which is nearly half of the $85 billion in forecasted total TV advertisement revenue. OTT threatens to cut short the lifespan of traditional linear TV, including live broadcasts.

We have seen customers such as DirecTV announce that they will shift all their future traffic to fiber network. Since most of the satellite operators generate most of their revenue from video distribution services (e.g. SES %65 Video, %35 Network in 2018, Intelsat %44 Video, %38 Network, %18 Government in 2018), this part of their revenue will be impacted by OTT services. The global satellite operators and regional operators are Rapid expansion of terrestrial networks and applications sway satellite customers to reconsider their future commitment to geostationary satellites (GEOs) FUTURE OF GEOSTATIONARY SATELLITES Most of the satellite operators generate most of their revenue from video distribution services. (e.g. SES %65 Video, %35 Network in 2018, Intelsat %44 Video, %38 Network, %18 Government in 2018). The global satellite operators and regional operators are continuing to report reduction of their revenues.

OTT threatens to cut short the lifespan of traditional linear TV, including live broadcasts. We have seen customers such as DirecTV announce that they will shift all their future traffic to fiber network. The LEO satellite threat could be devastating to GEO service providers in terms of Data Market as broadcast revenues decrease and Network services become a larger part of their revenue. continuing to report reduction of their revenues. Only HD, 4K and localised channels in developing regions without access to high-speed broadband will continue to be distributed through satellites. However, satellite bandwidth technology must step up to compete with fiber-based technology and improve its financial proposition to broadcasters and end users. Additionally, we are experiencing a wave of upcoming Low Earth Orbit (LEO) projects which are targeting the satellite industry. Four key advantages of LEO over GEO are:

• Reduced latency: LEO provides 30- 50 msec almost 1/10th the signal latency of GEO networks which is approximately 600 msec – enabling fast response for many data applications used today including voice services. • Global coverage: LEO offers a global network with services around the globe in contrast with GEO regional services.

• Better performance & quality: LEO’s proximity to earth reduces the path that signals travel anywhere between 30 – 90 times less than that of GEO. This has a big effect on data-path resource management built on top of packet communication protocols. LEO will provide better Layer 2 and Layer 3 performance than GEO networks.

• Affordable: The bandwidth supply will increase by LEO megaconstellations, and the price per bit will be expected to reduce accordingly.

The LEO satellite threat could be devastating to GEO service providers as broadcast revenues decrease and Network services become a larger part of their revenue. In recent years, High Throughput Satellites (HTS) have transformed the satellite communications industry. Several further HTS programs are underway for launch in the coming years. HTS is the communications satellite that provides though usually by a factor of 20 or more the total throughput of a classic FSS (Fixed Satellite Service) satellite for the same amount of allocated orbital spectrum, thus significantly reducing cost per bit. The considerable increase in capacity is achieved by a high level frequency re-use and multi-spot beam technology. However even though HTS technology is a great success in the satellite industry, it will not be enough alone to compete with all the advantages which terrestrial and megaconstellations promise.

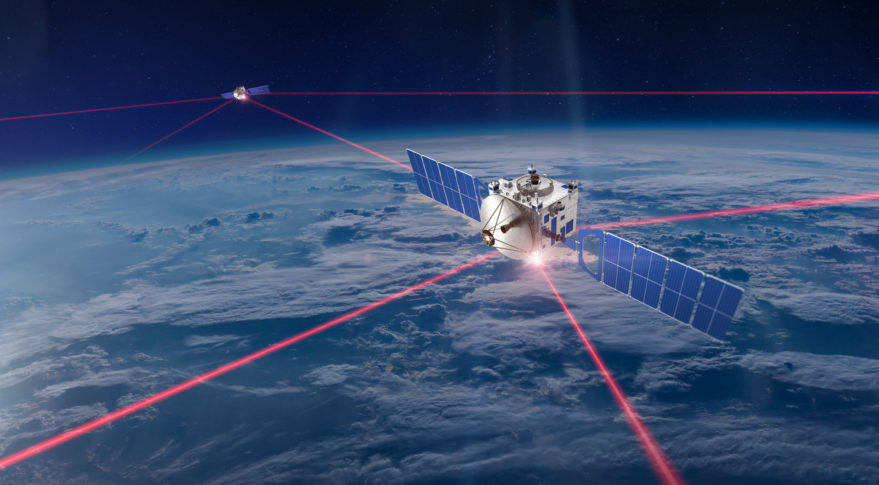

FSS operators must rationalize their fleets to save costs, and expand capacity to capture new market opportunities, while ensuring service continuity for current missions. Satellites should have reconfigurable payloads that fully integrate into the network. Flexible payload components are required by operators in today’s highly competitive satellite communications market. In particular, being able to dynamically modify antenna beam patterns in orbit to respond to market demands continues to play a critical part. The so called “digital beamforming” will most likely become a norm for the next generation geostationary satellites. While these are the most important trends, there are a few others such as micro-wave or optical inter-satellite links, use of Multiprotocol Label Switching (MPLS) in satellite networks and onboard switching application considering quality of service (QoS) which currently hold a crucial role in shaping the satellite space. Inter-satellite Links (ISL) can improve and expand communications satellite services in a number of ways. As the demand for orbital slots within prime regions of the geostationary arc increases, ISL can effectively conserve the spectral resources allocated for fixed satellite services by replacing the uplink/downlink bandwidth with the ISL frequency band.

An ISL replacing the multiple hopping system also provides reduced signal propagation delay and improved quality of signal transmission, where increased geographical coverage and traffic interconnectivity are achieved by ISL. The crucial question is: Can the use of ISL enable cost-effective alternatives to existing satellite communication systems? While it could be argued that for any local or regional satellite operator, complete global, worldwide coverage ISL for which the network satellites are interconnected to provide complete worldwide traffic interconnectivity will definitely have cost advantages compared to ones which require many ground earth stations and fiberoptic connectivity; L-band fleets and GEOHTS fleets to provide global service will be the top candidates for ISL application. In conclusion, the past decades have proven to be remarkable milestones in the Satellite Communications technologies, with important advances in space-based systems, new terminal capabilities, extensive coverage, versatile use and high performance. Next generation requirements will include further flexibility in coverage in terms of area and beam shape, orbital location flexibility, type of service in time and geographical traffic variation, flexible gateway locations, and progressive service deployment.

As the economy of nations become more global, the need for efficient interconnectivity via satellite communications will gain priority. Thus it is still rather early stages of design to predict the future of leading trends in the satellite industry, but it is easy to foresee that a lot of change and innovation is expected over the coming years with respect to making geostationary satellites more advanced and smarter. Inevitable sources of change due to shape the future of satellite communications will encompass new service demands in the commercial and defence related markets, restructuring of satellite organisations via new mergers and takeovers, new allocation of frequencies, and the market shift to software defined networking and virtualised architectures. It is still rather early stages of design to predict the future of leading trends in the satellite industry, but it is easy to foresee that a lot of change and innovation is expected over the coming years with respect to making geostationary satellites more advanced and smarter.